Penny to penny, on how to improve the accuracy of GA4 data collection

- Bluerank & mFinanse

The implementation of Google Analytics 4, provides opportunities to introduce customised solutions to better tailor analytics to the needs of a particular website or business. This translates into a deeper understanding of users' needs and behaviours, and therefore a better tailoring of the offer to their expectations.

Challenges

Our task was to implement Google Analytics 4 (GA4) for mFinanse.pl and policzkredyt.pl, using Google Tag Manager. The company helps clients calculate their creditworthiness and discern among mortgages or cash loans. mFinanse also provides credit calculators and compares the offers of many banks, which allows users to make informed financial decisions.

As part of the implementation of Google Analytics 4, we focused on collecting the most accurate data possible, especially that from the various calculators embedded on the website. Accuracy was key due to their importance in the marketing decision-making process.

Once the implementation was complete, we conducted a workshop for the company's employees to familiarise them with the new form of reports in GA4. This workshop was designed to demonstrate the benefits of the new tool and how to interpret the data collected.

strona główna mfinanse.pl

Strategy and implementation

Step 1 - Analysis of customer needs

The meeting with the mFinanse team proved to be very valuable. During the discussions with the marketing experts, we discussed key aspects of their activities, such as business goals and KPIs on each element of the potential customer path.

To further understand what data we should focus on, we conducted an analysis of the Universal Analytics implementation. In doing so, we wanted to identify and confirm key metrics, indicators and targets.

credit score calculator

Step 2 - Website analysis

Analysis of the website revealed the use of a security mechanism called 'Content Security Policy' (CSP). CSP allows web application developers to define the sources from which additional resources used by the application, such as external JavaScript files, can come. The main purpose of such security measures is to prevent XSS (Cross-Site Scripting) attacks, which attempt to insert malicious codes into web forms or application URLs.

Due to the number of calculators, the lack of built-in data layers (Data Layer) and the presence of the CSP mechanism, custom solutions were required.

We created a script for this purpose, which we then implemented using Google Tag Manager (GTM). It takes data from the calculators, generates data layers and then allows this data to be used to feed into Google Analytics 4 (GA4).

credit score calculator data layer

Step 3 - Implementation and deployment plan

With the tool developed and an implementation plan built, we set about implementing the relevant events on the site, including conversion events. The plan included events such as form interactions, uploads from individual calculators, user clicks, but also more micro KPIs such as time spent on the blog or page scroll depth.

Step 4 - Data verification

Verification of the implementation into GA4 is an important part of the analytical process. We checked the validity of the data collected and its quality. In this way, we were able to ensure that the analyses would be based on reliable data. The check included reviewing reports, configurations and comparing results with other data sources such as the client's CRM.

Step 5 - Documentation

At the end of the work, we prepared detailed documentation that covers the entire implementation process, the implemented events, the rules triggering them and the parameters. This documentation is a valuable source of information for all members of the mFinanse team, facilitating both the understanding of the functioning of the implementation and possible modifications. In addition, it fosters consistency of operations for the future.

Step 6 - Workshop

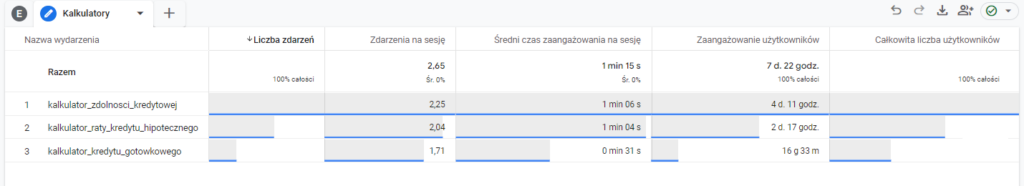

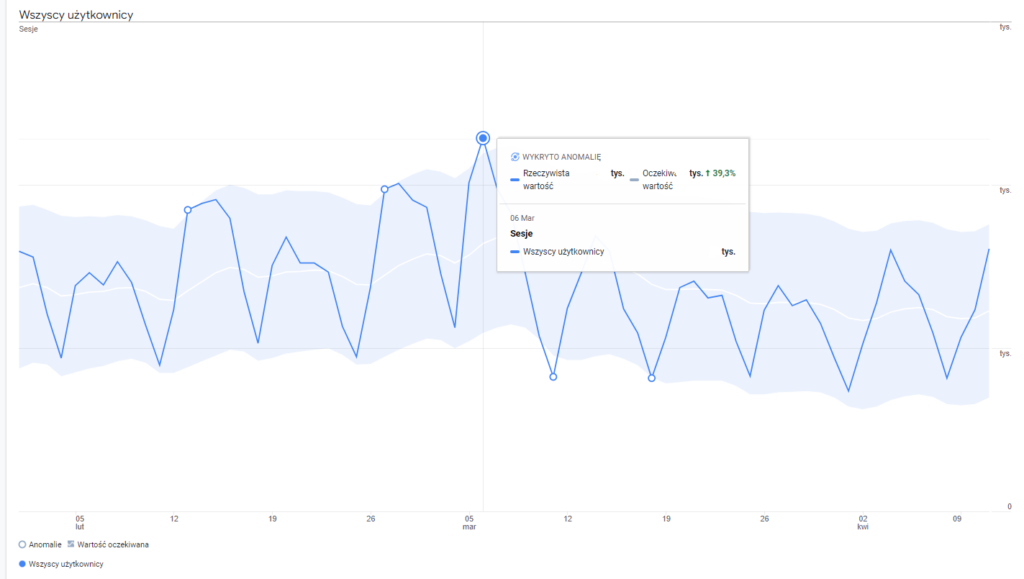

During the workshop, participants had the opportunity to familiarise themselves with the key functionalities of the GA4 tool. We prepared dedicated reports that allowed a better understanding of the specifics of the business and the needs of the company, such as which calculator users use most often or a report on detecting anomalous user sessions.

Google Analytics 4 – exploration report, calculators

Google Analytics 4 – exploration report, calculators

Google Analytics 4 – exploration report, anomaly detection

The presentation also covered the use of documentation and data collected in GA4 to create personalised information summaries.

In addition, the information collected, such as time spent on the blog, scroll depth and user 'path sequence exploration' type reports, allowed the identification of areas that may need to be refined or modified to further develop and improve the service provided.

Results

The implementation of customised solutions and integration with Google Analytics 4 has influenced the quality of data analysis on the mFinanse website. As a result, the collected data is more accurate, it has enabled better optimisation of marketing strategies and understanding of user needs. As a result, both mFinanse and their clients gain a better tool and a tailored offer.

Google Analytics 4 - events

Since we, as mFinanse, started to develop and expand online customer acquisition channels, it has been extremely important for us to analyse, track user behaviour, draw conclusions and, above all, adapt to the changing trends and demands of our future customers. We know how difficult online operations in the financial industry are, how much competition there is and what customer queries we have to deal with. Therefore, the implementation of GA4 was a mandatory task for us and we wanted to do it as accurately and efficiently as possible. This is another time when Bluerank has responded to our needs. It is never easy to face new solutions, but fortunately we are ready for the changes that Google imposes on us and, moreover, well in advance :)

Marta Oleksiak Digital Manager, mFinanse